Bull Call Spread Option Calculator

Please Input Details

Profit and Loss Calculation

| Nifty at Expiration | Long Call P and L | Short Call P and L | Net P and L |

|---|

Break-even Points

The Bull Call Spread is a popular option trading strategy used by traders when they anticipate a moderate rise in the price of the underlying asset. This strategy involves purchasing call options at a specific strike price while simultaneously selling the same number of call options at a higher strike price.

Components of a Bull Call Spread

A Bull Call Spread consists of two main components:

- Long Call Option: Buying a call option at a lower strike price.

- Short Call Option: Selling a call option at a higher strike price.

How It Works

The strategy is designed to limit both potential gains and potential losses. The maximum profit is realized if the underlying asset's price is above the higher strike price at expiration, while the maximum loss is limited to the net premium paid for the spread.

Example Scenario

Consider a stock currently trading at $100:

- Buy a call option with a strike price of $100 for a premium of $5.

- Sell a call option with a strike price of $110 for a premium of $2.

The net premium paid is $3 ($5 paid - $2 received). The maximum profit is $7 per share ($10 difference in strike prices - $3 net premium), and the maximum loss is $3 per share (the net premium).

Benefits of Bull Call Spread

- Limited Risk: The maximum loss is limited to the net premium paid.

- Lower Cost: The net premium paid is typically lower than buying a single call option outright.

- Profit Potential: Allows traders to profit from a moderate increase in the underlying asset's price.

Risks and Considerations

While the Bull Call Spread offers several advantages, it also comes with certain risks and considerations:

- Limited Profit: The profit potential is capped due to the short call option.

- Expiration Date: The strategy is time-sensitive and depends on the options' expiration dates.

- Market Movement: If the underlying asset's price does not move as anticipated, the strategy may result in a loss.

Note - The Bull Call Spread is a strategic choice for traders expecting a moderate rise in the price of an underlying asset. By limiting both potential gains and losses, it provides a balanced approach to options trading. However, like any trading strategy, it requires careful consideration of market conditions and timing.

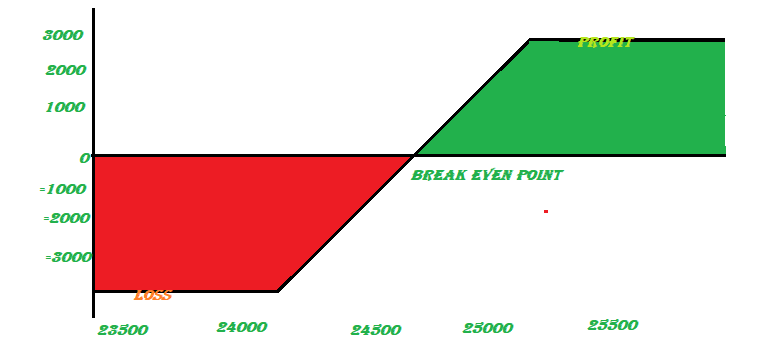

Example Scenario: Nifty Spot at 24324

Consider a Bull Call Spread strategy with the following details:

- Current Nifty Spot Price: 24324

- Buy a call option with a strike price of 24300 for a premium of ₹100

- Sell a call option with a strike price of 24500 for a premium of ₹50

Profit and Loss Calculation

| Nifty at Expiration | Long Call (24300) P and L | Short Call (24500) P and L | Net P and L |

|---|---|---|---|

| 24000 | -₹100 | ₹50 | -₹50 |

| 24300 | -₹100 | ₹50 | -₹50 |

| 24400 | ₹0 | ₹50 | ₹50 |

| 24500 | ₹100 | ₹0 | ₹100 |

| 24600 | ₹200 | -₹100 | ₹100 |

| 25000 | ₹500 | -₹400 | ₹100 |

Maximum Profit and Loss

The maximum profit is ₹100, which occurs if Nifty is at or above 24500 at expiration. The maximum loss is ₹50, which occurs if Nifty is at or below 24300 at expiration.