☰

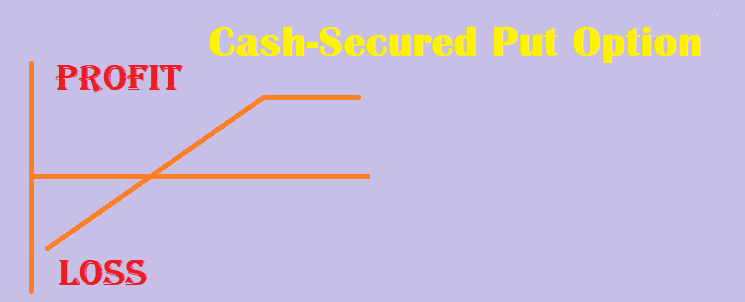

Mastering the Cash-Secured Put Option Strategy

Introduction:

By understanding the intricacies of this strategy, investors can capitalize on market conditions and potentially acquire stocks at favorable prices.

Understanding the Cash-Secured Put Option Strategy:

The Cash-Secured Put Option Strategy involves selling put options on a security while ensuring that the investor has sufficient cash reserves to purchase the underlying asset if the option is exercised. This strategy allows investors to potentially earn premium income upfront and potentially acquire the stock at a discounted price if the stock price declines.

Key Components of the Cash-Secured Put Option Strategy:

- Put Option Sale:

- The strategy begins by selling a put option on a specific stock or asset. The put option provides the buyer with the right, but not the obligation, to sell the underlying asset at a predetermined price (strike price) within a specific time frame (expiration date). By selling the put option, the investor receives an upfront premium.

- Cash Reserve:

- To execute the Cash-Secured Put Option Strategy, the investor must set aside cash equal to the strike price of the put option multiplied by the number of shares the option controls. This cash serves as collateral to cover the potential obligation of purchasing the underlying asset if the option is exercised.

Benefits of the Cash-Secured Put Option Strategy:

- Income Generation:

- Selling put options allows investors to earn premium income upfront. If the put option expires worthless (out-of-the-money), the investor retains the premium as profit. Even if the put option is exercised, the investor still keeps the premium received.

- Potential Stock Acquisition:

- If the put option is exercised and the investor is obligated to purchase the underlying asset, they have the opportunity to acquire the stock at a potentially discounted price. This strategy can be particularly appealing to investors looking to accumulate stocks at lower prices.

- Risk Mitigation:

- The cash reserve required for the strategy acts as a safeguard. By setting aside the necessary funds, investors are prepared to purchase the underlying asset at the predetermined strike price if required. This helps mitigate the risk of unexpected market movements and potential losses.

Considerations and Trade-Offs:

- Obligation to Purchase:

- Selling a put option entails the obligation to buy the underlying asset if the option is exercised. Investors should be prepared to fulfill this obligation and have the necessary funds available in their cash reserve.

- Potential Stock Ownership:

- Investors implementing the Cash-Secured Put Option Strategy must be comfortable with the possibility of acquiring the underlying stock. Thorough research and analysis of the stock's fundamentals and long-term prospects are crucial to ensure alignment with investment objectives.

- Market Volatility:

- The strategy's success relies on stable or bullish market conditions. Investors should be mindful of potential volatility and the impact it can have on the stock's price and their cash reserve requirements.