Unleashing the Power of Covered Calls: A Guide to Enhancing Your Options Trading

Introduction:

Welcome to the exciting world of options trading, where investors employ a multitude of strategies to optimize their returns and manage risk. In this blog post, we will delve into one popular and effective strategy known as the Covered Call. This strategy allows traders to potentially generate income from their existing stock holdings while providing a level of downside protection. Whether you are a novice or an experienced trader, understanding Covered Calls can enhance your options trading repertoire.

- To implement a Covered Call strategy, you typically follow these steps:

- Choose the underlying stock:

- Select a stock that you currently own or are willing to purchase, taking into consideration factors such as its stability, dividend yield, and overall market outlook.

- Determine the strike price and expiration date:

- Decide on the strike price at which you are comfortable selling your shares if the options are exercised. Additionally, select an expiration date that aligns with your investment timeframe and goals.

- Sell call options:

- Sell call options contracts against your stock holdings. For each 100 shares of stock, sell one call option contract. The premium received from selling the calls generates immediate income.

- Stock price remains below the strike price:

- In this case, the call options will expire worthless, allowing you to keep the premium as profit. You still own the stock and can sell additional call options in the future.

- Stock price rises above the strike price:

- If the stock price exceeds the strike price, the options may be exercised by the buyer. You will need to sell your shares at the strike price, but you still keep the premium received. While you miss out on potential stock gains beyond the strike price, the premium helps offset this loss.

- Stock price falls significantly:

- Even if the stock price declines substantially, the premium received from selling the call options provides a degree of downside protection. It can help reduce the overall loss on the stock position.

- Income generation:

- The primary benefit of Covered Calls is the ability to generate additional income from your existing stock holdings, potentially boosting overall returns.

- Downside protection:

- By selling call options, you create a cushion against potential losses in the stock position, reducing the overall risk.

- Flexibility:

- Covered Calls provide flexibility, allowing you to adjust strike prices and expiration dates based on your market outlook and investment goals.

- Volatility:

- Higher implied volatility generally leads to higher option premiums, making it an advantageous time to sell Covered Calls.

- Stock selection:

- Choose stocks that you are comfortable owning for the long term and have sufficient liquidity and options trading volume.

- Opportunity cost:

- Selling Covered Calls limits the potential upside of your stock position. Assess the trade-off between potential stock gains and the income generated from the options premiums.

- Select the Underlying Stock:

- Suppose you own 200 shares of a stable and well-established company listed in the Dow Jones Industrial Average (DJIA) index.

- Sell Call Options:

- As a Covered Call strategy, you would sell call options against your stock position. Since each options contract typically represents 100 shares, you can sell two call option contracts (200 shares divided by 100) for this example. By selling the call options, you receive premiums, which provide immediate income.

- Profit and Loss Potential:

- With the Covered Call strategy, there are several potential outcomes:

- Stock price remains below the strike price:

- If the Dow spot price remains below the strike price of $36,000 by the expiration date, the call options will likely expire worthless. You keep the premiums received from selling the options as profit, while still retaining ownership of your stock position.

- Stock price rises above the strike price:

- Should the Dow spot price exceed the strike price and the call options get exercised, you will need to sell your shares at the strike price of $36,000. While you miss out on potential stock gains beyond that level, you still retain the premiums received. These premiums help offset the loss of potential gains and provide additional income.

- Stock price falls significantly:

- Even if the Dow spot price experiences a substantial decline, the premiums received from selling the call options act as a cushion, reducing the overall loss on your stock position. This downside protection helps mitigate potential losses.

What is a Covered Call?

A Covered Call is an options trading strategy that involves selling call options against a stock position you already own. The term "covered" refers to the fact that the seller holds the underlying shares, which act as collateral or coverage for the potential obligation of delivering the shares if the options are exercised.

How Does the Covered Call Work?

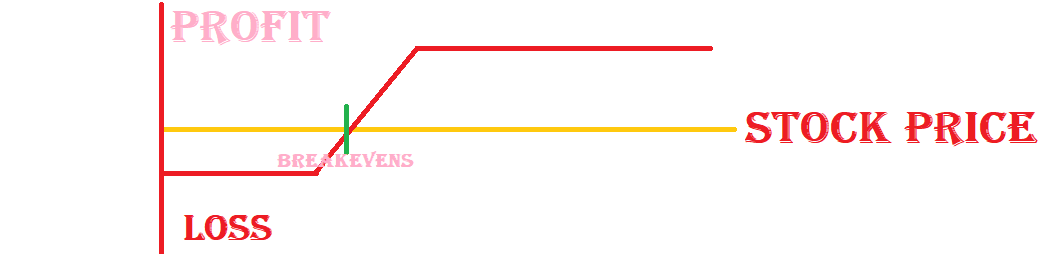

Profit and Loss Potential:

The Covered Call strategy allows traders to potentially earn income through the premiums received from selling call options. There are three possible scenarios:

Benefits of the Covered Call Strategy:

Considerations Before Trading Covered Calls:

Before implementing Covered Calls, it is important to consider the following:

Let's explore an example of how the Covered Call strategy could be implemented based on a hypothetical Dow spot price of 35,000.

Determine the Strike Price and Expiration Date:

Choose a strike price that you would be comfortable selling your shares at if the options are exercised. For this example, let's assume you select a strike price of $36,000, which represents a potential profit if the stock price reaches that level. Additionally, select an expiration date that aligns with your investment objectives, such as three months from the current date.