Unleashing the Potential: Exploring the Long Call Option Strategy

Introduction:

In the realm of options trading, numerous strategies offer the potential for profit and risk management. Among these strategies, the Long Call Option Strategy stands out as a popular choice for traders seeking to capitalize on upward price movements. By understanding the intricacies of the long call strategy, investors can unlock opportunities to amplify their gains in the market.

Understanding the Long Call Option Strategy:

The Long Call Option Strategy involves purchasing call options on a specific underlying asset, such as a stock or index. This strategy enables investors to speculate on the price appreciation of the underlying asset without owning it outright. By leveraging the power of call options, investors can potentially amplify their returns if the price of the underlying asset rises.

Components of the Long Call Option Strategy:

- Call Option Purchase:

- The strategy begins with buying call options. A call option provides the holder with the right, but not the obligation, to buy the underlying asset at a predetermined price (strike price) within a specific time frame (expiration date). By purchasing call options, investors gain exposure to the potential price increase of the underlying asset.

- Premium Payment:

- Buying call options requires paying a premium, which is the cost of the options contract. This premium represents the initial investment and is determined by factors such as the strike price, expiration date, and implied volatility of the underlying asset.

Benefits of the Long Call Option Strategy:

- Upside Potential:

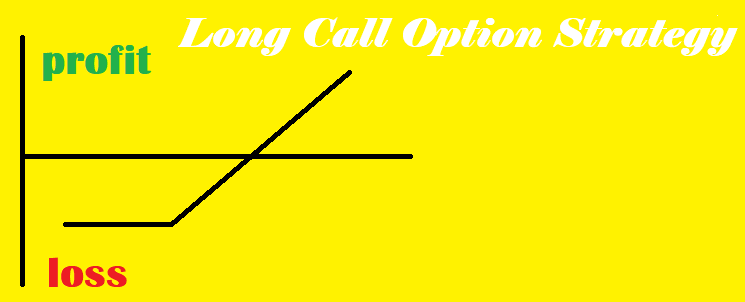

- The primary advantage of the long call strategy is the potential for significant upside gains. If the price of the underlying asset rises above the strike price, the value of the call options increases, allowing investors to profit from the price appreciation.

- Limited Risk:

- The risk associated with the long call strategy is limited to the premium paid for the call options. This predefined risk allows investors to have a clear understanding of their potential losses upfront, providing a controlled risk-reward profile.

- Leverage:

- Call options provide leverage, allowing investors to control a larger position in the underlying asset with a relatively small investment. This leverage can amplify returns compared to owning the asset outright, potentially magnifying profits in a favorable market scenario.

Considerations and Trade-Offs:

- Time Decay:

- As the expiration date approaches, the value of options contracts may decrease due to time decay. This means that the longer the time until expiration, the higher the chances of the underlying asset reaching the desired price level.

- Breakeven Point:

- In order to profit from the long call strategy, the price of the underlying asset must rise sufficiently to cover the premium paid for the call options. Investors need to carefully analyze the expected price movement to ensure the asset's appreciation exceeds the breakeven point.

- Limited Losses:

- While the risk is limited to the premium paid, investors should be aware that if the price of the underlying asset does not reach the strike price by expiration, the options may expire worthless, resulting in a 100% loss of the premium.